Objective Tagging: Opex vs Capex

This is one of RoadmapOne ’s articles on Objective Tagging methodologies .

Your CFO needs to know something that most product roadmaps can’t tell them: how much of next quarter’s engineering spend will be capitalised versus expensed. Get this wrong, and you’re either understating your assets (annoying the board) or overstating them (annoying your auditors). Neither conversation is fun.

Tagging objectives as Opex or Capex isn’t just accounting pedantry—it’s strategic intelligence. It tells you whether you’re building new capabilities (Capex) or keeping the lights on (Opex). And crucially, it gives your finance team the visibility they need months before budget reviews, not days.

What Are Opex and Capex?

Let’s keep this brutally simple:

Operational Expenditure (Opex) is your day-to-day running costs. It’s money you spend and immediately expense on your P&L. Think salaries, cloud hosting, software subscriptions, bug fixes, and maintenance work—what we often call Keeping The Lights On (KTLO) . Opex hits your profit margin directly, right now.

Capital Expenditure (Capex) is spending on assets that provide value over multiple years. It goes on your balance sheet and depreciates over time. Think building new products, major platform upgrades, or substantial new features that extend your product’s useful life or capability.

The distinction matters because:

- Capex can be depreciated over several years, smoothing the P&L impact

- Opex hits immediately, affecting this quarter’s profitability

- Tax treatment differs significantly between the two

- Investor perception varies—high Capex signals growth investment, high Opex suggests operational inefficiency

Why Your Finance Team Cares

Your finance team isn’t being difficult when they ask about Opex vs Capex. They’re trying to:

Forecast accurately. They need to model cash flow, depreciation schedules, and tax liabilities. “We’re spending £2M on engineering” isn’t enough—they need to know if that’s £1.5M Opex and £500k Capex, or the reverse.

Optimise tax position. Different tax treatments between Opex and Capex can materially affect your tax bill. In some jurisdictions, R&D Capex attracts significant R&D tax credits . Your finance team needs advance warning to structure spending optimally.

Communicate with the board. Directors care about the balance between investing in growth (Capex) and maintaining current operations (Opex). A roadmap that’s 90% Opex suggests you’re not innovating. One that’s 90% Capex might mean you’re neglecting critical maintenance.

Manage accounting compliance. Auditors scrutinise the Capex/Opex split carefully. Miscategorising significant spend can trigger restatements, audit qualifications, or regulatory issues. Your finance team needs confidence in the numbers.

Classifying Objectives as Opex or Capex

The accounting standards (known poetically as IFRS IAS 38 if you really want to freak out your finance team) provide detailed guidance, but here’s the practical product management version:

Opex Objectives typically involve:

- Bug fixes and maintenance – Keeping existing functionality working

- Performance improvements – Making current features faster or more stable

- Security patches – Addressing vulnerabilities in existing systems

- Refactoring without new capability – Improving code quality without changing what it does

- Running costs – Hosting, licenses, ongoing support

- Minor enhancements – Small improvements that don’t materially extend product life

Capex Objectives typically involve:

- New products or features – Creating new revenue streams or capabilities

- Major platform upgrades – Substantial improvements that extend useful life

- Scalability improvements – Building capacity for significant future growth

- New integrations – Adding functionality that opens new markets

- Regulatory compliance requiring new capability – Building features to enter new jurisdictions

- Substantial rewrites – Replacing systems to extend their viable lifespan

The key test: Does this work create or substantially improve an asset with multi-year value? If yes, it’s probably Capex. If it’s maintaining what you already have, it’s Opex.

When in Doubt: The “Unsure” Option

Classification isn’t always clear-cut. RoadmapOne includes an “Unsure” tag specifically for objectives that fall into grey areas or require finance team input.

Use “Unsure” when:

- The objective has both maintenance and new-capability components

- The multi-year value test is ambiguous

- Your auditors’ interpretation might differ from yours

- The classification could materially affect financial reporting

Crucially, “Unsure” is not indecision—it’s a signal for collaboration. It flags objectives that need finance team review before they hit the roadmap. Better to surface the question in planning than discover the classification issue during year-end close.

Common Classification Scenarios

| Objective | Classification | Reasoning |

|---|---|---|

| “Migrate from Oracle to Postgres” | Opex | Lateral move—maintains current capability, doesn’t create new value |

| “Build Swedish language version” | Capex | New market capability with multi-year revenue potential |

| “Reduce page load time <2 seconds” | Opex | Performance improvement to existing feature |

| “Launch mobile app” | Capex | New product channel with multi-year asset value |

| “Fix critical checkout bug” | Opex | Maintenance of existing functionality |

| “Implement AI-powered recommendations” | Capex | Substantial new capability creating competitive advantage |

| “Rebuild checkout to handle 10x scale” | Unsure | Could be Opex (maintaining service levels) or Capex (enabling future growth)—needs finance input |

| “Upgrade to latest framework version” | Opex | Maintaining current capability (unless it enables new features) |

| “Build API for partner integrations” | Capex | New platform capability with multi-year strategic value |

| “Major refactor of core billing engine” | Unsure | Maintenance work, but might materially extend platform lifespan—auditor interpretation varies |

The grey areas are real. A major refactoring might be Capex if it materially extends the platform’s useful life. An “upgrade” might be Capex if it enables substantial new capabilities. When in doubt, consult your finance team—they’ll know how your auditors interpret the standards.

The Strategic Value of Visibility

Here’s where it gets interesting: once you can see your Opex/Capex split across your roadmap, you can actually manage it.

Scenario: Your Q1 roadmap shows 85% Capex, 15% Opex. That looks impressive (lots of innovation!), but ask yourself: are we accumulating technical debt? Are we deferring critical maintenance? Will Q2 be 80% firefighting?

Scenario: Your annual roadmap shows 70% Opex, 30% Capex. You’re keeping the lights on, but where’s the growth? The board will ask why you’re not investing in new capabilities. Can you shift some capacity to higher-value Capex work?

Scenario: Your finance team flags that you need £800k more Capex spend this fiscal year to optimise your tax position. You can now look at your roadmap and ask: which Q4 objectives could reasonably be brought forward? Which Opex work could wait?

This isn’t financial engineering—it’s strategic resource allocation informed by financial reality.

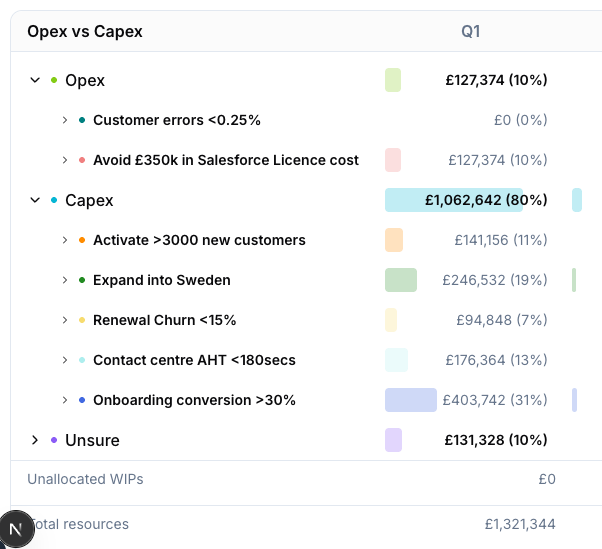

Using Opex vs Capex Tagging in RoadmapOne

RoadmapOne treats Opex vs Capex as just another objective tagging dimension. You can:

- Tag each objective as Opex or Capex when you create it

- Filter your roadmap view to see only Capex objectives (or only Opex)

- Use analytics to see quarterly Opex/Capex splits across your planning horizon

- Export the data for finance team forecasting and board reporting

The real power comes when you combine this with other tagging frameworks. An objective that’s both “Opex” and “Run the Business ” is pure maintenance. One that’s “Capex” and “Transform” is strategic investment. Your finance team can now have the conversation they actually need: not just “how much are you spending?” but “what are you buying with it?”

Key Takeaways

- Opex is day-to-day running costs that hit your P&L immediately; Capex is investment in multi-year assets that depreciate over time

- Finance teams need visibility months in advance to forecast, optimise tax position, and communicate with the board

- Classification depends on value creation: does the work create new capability with multi-year value (Capex) or maintain what exists (Opex)?

- Strategic visibility enables smart trade-offs—you can rebalance your roadmap based on financial optimisation, not just product priorities

- Combined with other frameworks, Opex/Capex tagging reveals whether you’re investing strategically or just keeping the lights on

For more on Objective Tagging methodologies, see our comprehensive guide .