Objective Prioritisation: Benefit

When Absolute Value Matters More Than Investment Efficiency

This is one of RoadmapOne ’s articles on Objective Prioritisation frameworks .

Sometimes the best prioritisation framework is no framework at all—just brutal honesty about value. Benefit prioritisation strips away every layer of complexity: no division by cost, no reach-times-impact multiplication, no confidence weighting. Just one question: “How much value does this objective deliver within our timeframe?” £350k beats £180k. £180k beats £90k. Sort by that number, fund what fits, and move on. When the CFO asks “which objectives deliver the most value?”, you don’t need to explain RICE scores or NPV discounting—you point at a sorted list of pound figures.

Benefit prioritisation is ROI’s simpler sibling. ROI divides benefit by build cost to optimise for investment efficiency. Benefit ignores cost entirely and optimises for absolute value magnitude. This matters when you’re capacity-constrained but not capital-constrained, or when the strategic imperative is maximising total value delivered rather than maximising value per pound invested. A feature that delivers £500k benefit for £200k cost (2.5× ROI) might rank below a feature delivering £800k benefit for £400k cost (2.0× ROI) if your goal is absolute value delivery.

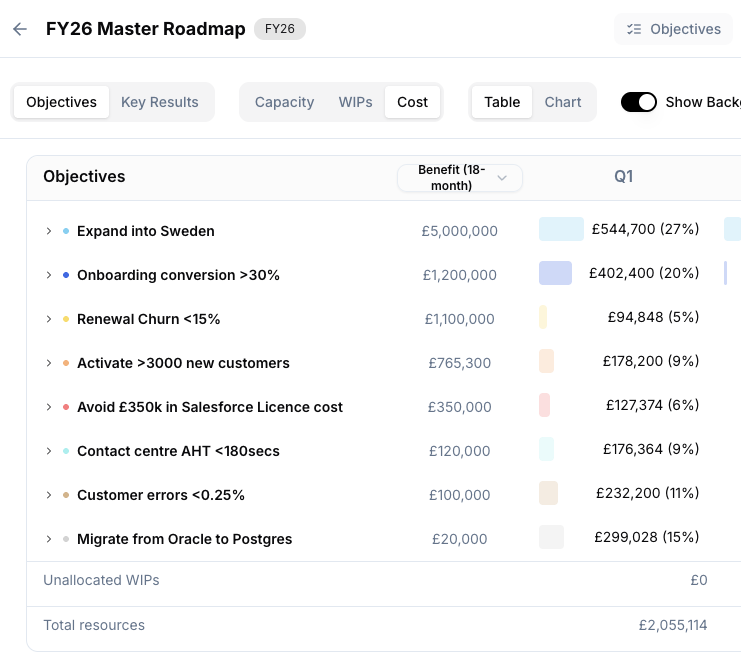

The framework is almost insultingly simple: pick a timeframe (12, 18, or 24 months), estimate the financial benefit within that window—net revenue generated or costs saved—and sort descending. But simplicity is a feature, not a bug. When finance and the board want transparency without spreadsheet theatre, Benefit delivers it. No hidden assumptions, no algorithmic black boxes, just pounds delivered. And don’t forget that RoadmapOne uses your roadmap to automatically calculate the projects costs, so your board/ExCo can instantly see the benefits and costs.

TL;DR: Benefit prioritisation ranks objectives by total value delivered (net or gross revenue or cost savings) within 12, 18, or 24 months—ignoring investment cost entirely. It’s the simplest possible financial framework, instantly understandable by boards and CFOs. But Benefit betrays you when investment costs vary wildly, when efficiency matters more than magnitude, or when teams game estimates to inflate rankings.

What Benefit Actually Measures

Benefit prioritisation answers: “How much financial value does this objective generate within our chosen timeframe?” If an objective delivers £280k in new recurring revenue over 18 months, its Benefit score is £280k. If another objective saves £150k in operational costs over 18 months, its Benefit score is £150k. The first objective ranks higher. No formulas, no adjustments, no complexity.

The metric is deliberately crude:

Benefit = Total Financial Value Delivered Within Timeframe

Where:

- Financial Value = Net new revenue OR cost savings realised

- Timeframe = 12, 18, or 24 months (choose one, apply consistently)

Unlike ROI, there’s no division by build cost. Unlike NPV, there’s no discounting. Unlike RICE, there’s no reach-times-impact-times-confidence calculation. Benefit is the numerator without the denominator—the value, unadorned.

The Three Timeframe Variants

Like ROI, RoadmapOne treats 12-month, 18-month, and 24-month Benefit as distinct frameworks because timeframe choice fundamentally changes what you’re measuring.

12-Month Benefit captures near-term value. Use this when quarterly targets dominate, when cash flow visibility beyond a year is fiction, or when leadership demands immediate results. The risk: you’ll starve strategic investments that compound slowly.

18-Month Benefit balances short-term delivery with medium-term accumulation. It’s the default for most mature teams—long enough to capture compounding effects, short enough that projections remain grounded in reality.

24-Month Benefit works for strategic bets where value builds over time. Platform plays, market expansions, and ecosystem investments often deliver modest year-one benefits but accelerate in year two. The risk: projections become fantasy, and teams inflate 24-month estimates to game rankings.

Pick one timeframe per roadmap and measure every objective consistently within that window. This prevents selective gaming where teams pick short windows for quick wins and long windows for pet projects to make everything look valuable.

Benefit in Action: Three Scenarios Across Timeframes

Scenario A: Enterprise Contract Expansion Feature

Build Cost: £200,000 (not used in Benefit scoring, but relevant for context)

Benefit Projections:

- Months 1-12: £150,000 (12 enterprise expansions at £12.5k average uplift)

- Months 13-18: £100,000 (8 additional expansions)

- Months 19-24: £130,000 (10 more expansions as sales pipeline matures)

Benefit Scores:

- 12-month Benefit: £150k

- 18-month Benefit: £250k

- 24-month Benefit: £380k

Verdict: The benefit compounds modestly but steadily. On 12-month Benefit, this might rank mid-pack. On 24-month Benefit, it’s a strong contender. But notice we’re ignoring the £200k investment cost—pure Benefit prioritisation doesn’t care about efficiency, only magnitude.

Scenario B: Operational Cost Reduction (Infrastructure Optimisation)

Build Cost: £50,000 (minimal engineering, mostly migration effort)

Benefit Projections:

- Months 1-12: £180,000 (AWS bill reduction + support time savings)

- Months 13-18: £90,000 (ongoing savings continue)

- Months 19-24: £90,000 (stable recurring savings)

Benefit Scores:

- 12-month Benefit: £180k

- 18-month Benefit: £270k

- 24-month Benefit: £360k

Verdict: Infrastructure optimisation delivers strong near-term benefit that plateaus. The 12-month Benefit (£180k) beats Scenario A (£150k), even though Scenario A might deliver better ROI (£380k benefit ÷ £200k cost = 1.9× vs £360k ÷ £50k = 7.2×). Benefit prioritisation says “take the higher absolute value.” ROI prioritisation says “infrastructure is 3.8× more efficient.”

Scenario C: Strategic Platform Investment

Build Cost: £500,000 (large, multi-quarter effort)

Benefit Projections:

- Months 1-12: £80,000 (slow initial ramp)

- Months 13-18: £200,000 (network effects accelerate)

- Months 19-24: £450,000 (ecosystem momentum kicks in)

Benefit Scores:

- 12-month Benefit: £80k (ranks last)

- 18-month Benefit: £280k (competitive)

- 24-month Benefit: £730k (ranks highest)

Verdict: Benefit prioritisation on 24-month windows rewards this platform bet (£730k beats everything). But it’s also costing £500k to build, while infrastructure optimisation (Scenario B) costs £50k and delivers £360k. Pure Benefit scoring ignores this efficiency gap entirely. If you have the capital and capacity, Benefit says “fund the platform for maximum absolute value.” If capital is scarce, ROI says “infrastructure delivers better returns.”

When Benefit Is Your Best Weapon

Benefit excels in four contexts.

First: When investment costs are roughly uniform. If all your objectives cost £100-150k to build, dividing by cost adds noise without signal. Benefit prioritisation lets you optimise for value delivered without false precision about cost efficiency. This is common in mature product teams where most features require similar squad allocation over similar timeframes.

Second: When capacity is constrained but capital isn’t. Some organisations have more budget than squad availability. They can fund any objective financially but can’t execute more than 15 objectives per quarter. In this context, maximising absolute value delivered makes sense—fund the highest Benefit objectives that fit your capacity, and don’t worry about cost efficiency.

Third: When the board wants maximum simplicity. CFOs and non-technical board members understand “this objective delivers £350k over 18 months” immediately. They don’t understand RICE scores (what does 847.3 mean?), they find NPV’s discounting pedantic, and ROI multiples require mental gymnastics to compare (is 4.2× better than 3.8× enough to justify lower absolute value?). Benefit is transparent.

Fourth: When strategic goals are value-maximisation, not efficiency-maximisation. If this quarter’s OKR is “deliver £2M in customer value” rather than “achieve 3.5× average ROI,” Benefit prioritisation aligns perfectly. You’re literally optimising for the metric that matters.

When Benefit Betrays You

Benefit collapses in three scenarios.

First: When investment costs vary wildly. If Objective A costs £50k and delivers £200k benefit (4× ROI), while Objective B costs £400k and delivers £220k benefit (0.55× ROI), pure Benefit scoring ranks B higher (£220k > £200k). But you’d be insane to fund B—it’s destroying value. Benefit prioritisation can accidentally fund value-destroying work if you ignore costs entirely.

Second: When capital is scarce and efficiency matters. Cash-constrained startups, organisations with fixed budgets, or teams managing P&L accountability need to maximise value per pound invested, not absolute value. A feature delivering £300k for £100k investment (3× ROI) is better than one delivering £350k for £250k investment (1.4× ROI) when every pound matters. Benefit scoring picks the wrong one.

Third: When teams game benefit estimates. Without the forcing function of dividing by cost, product managers inflate benefit projections to rank their pet projects higher. “This will save £500k annually!” becomes the standard claim, backed by fantasy spreadsheets. The cure is brutal calibration: track actual delivered benefit versus projected, publish retrospectives, and penalise chronic over-estimators.

Benefit vs ROI vs Pure Magnitude

These frameworks sit on a spectrum from complexity to simplicity:

ROI asks: “How many times our investment do we get back?” Use when efficiency matters—when capital is constrained, when stakeholders demand return multiples, or when comparing investments of radically different sizes.

Benefit asks: “How much absolute value do we deliver?” Use when capital is available but capacity isn’t, when objectives have similar costs, or when board-level communication demands maximum simplicity.

Pure Magnitude (RICE/ICE without effort weighting) asks similar questions but without financial specificity. Benefit is the financially explicit cousin of “impact” scoring—it forces teams to quantify value in pounds, not abstract points.

Most organisations use multiple frameworks: Benefit for board-level portfolio discussions (maximise total value delivered this year), ROI for capital allocation decisions (which features justify their investment?), and RICE or ICE for day-to-day execution prioritisation (what delivers value efficiently?).

For more on ROI, see ROI Prioritisation . For financial frameworks with discounting, see NPV Prioritisation .

Practical Implementation

Define your timeframe first. Choose 12, 18, or 24 months based on forecasting confidence and strategic horizon. Stick with it for the entire roadmap to prevent gaming.

Quantify benefits conservatively. New revenue (gross or net, be consistent), retained revenue, or cost savings—all count. Use historical data where possible. If your last three “£200k benefit” projections actually delivered £140k, apply a 0.7× confidence haircut to new estimates.

Decide: Gross or Net revenue? Gross revenue (total contract value) is simpler but ignores delivery costs. Net revenue (gross minus COGS and direct costs) is more accurate but requires finance collaboration. Pick one approach and apply it consistently.

RoadmapOne automatically calculates initiative costs. As you allocate objectives to squads and sprints, RoadmapOne tracks total investment cost by summing the capacity allocated—both by quarter and as a total investment. This automatic cost calculation is visible in the grid and in reporting, giving you real-time visibility into how much each initiative is consuming. While Benefit prioritisation doesn’t divide by cost, having accurate cost data visible lets you spot value-destroying outliers and cross-check with ROI when needed.

Sort by Benefit and fund above the capacity line. If Objective A delivers £450k, Objective B delivers £280k, and Objective C delivers £180k, and you have capacity for two objectives, fund A and B. Ignore costs unless they’re value-destroying outliers.

Cross-check with ROI for sanity. Calculate ROI for your top-Benefit objectives to ensure you’re not accidentally funding low-efficiency work. If your top-5 Benefit objectives all show ROI below 1.5×, you’re prioritising badly—pure magnitude is leading you astray.

Track actual versus projected benefit. Six months post-launch, measure actual value delivered versus Benefit projections. Publish calibration data to improve future estimates and expose chronic over-estimators.

The Honest Conversation About What Matters

The most valuable thing Benefit prioritisation forces is the question: “Do we care more about value magnitude or investment efficiency?”

Some organisations genuinely optimise for total value delivered—they have capital, they have capacity constraints, and they want to ship the highest-value work that fits. Benefit prioritisation aligns with this perfectly. It’s honest: we’re not optimising for ROI, we’re optimising for absolute value contribution.

Other organisations need efficiency because capital is scarce or because P&L accountability demands it. For them, Benefit prioritisation is dangerous—it can accidentally fund expensive, low-efficiency work just because the absolute numbers look big. These teams need ROI or NPV.

The framework choice is strategic self-awareness made explicit. Are you maximising value delivered, or value per pound invested? Both are legitimate strategies, but they produce different roadmaps.

If you take only three ideas from this essay, let them be:

-

Benefit Is the Simplest Financial Framework—Just Pounds Delivered. No formulas, no ratios, no abstract scores. Just total value delivered within your timeframe. Use Benefit when board-level communication demands transparency and when objectives have roughly similar costs.

-

Benefit Ignores Efficiency—This Is Both Its Strength and Its Danger. When capital is plentiful but capacity is constrained, maximising absolute value makes sense. When capital is scarce, ignoring investment efficiency can lead you to fund value-destroying work. Know which context you’re in.

-

Timeframe Choice (12/18/24 Months) Reveals Strategic Patience. Teams that only trust 12-month benefits optimise for near-term certainty. Teams that routinely use 24-month windows either have strong forecasting discipline or are engaging in long-range fiction. Pick your window, measure consistently, and let the choice expose your risk tolerance.

RoadmapOne supports Benefit-based prioritisation for teams wanting maximum simplicity without sacrificing financial rigour. Choose your timeframe (12, 18, or 24 months), estimate value delivered (revenue or cost savings), sort by magnitude, and fund what fits. Then cross-check with ROI to ensure you’re not accidentally prioritising inefficient work.

Benefit won’t capture investment efficiency. It won’t balance reach versus impact. It won’t tell you if you’re starving strategic bets. But when the board asks “which objectives deliver the most value?” and you need an answer they’ll understand in five seconds, Benefit delivers clarity without compromise.

For more on Objective Prioritisation frameworks, see our comprehensive guide .